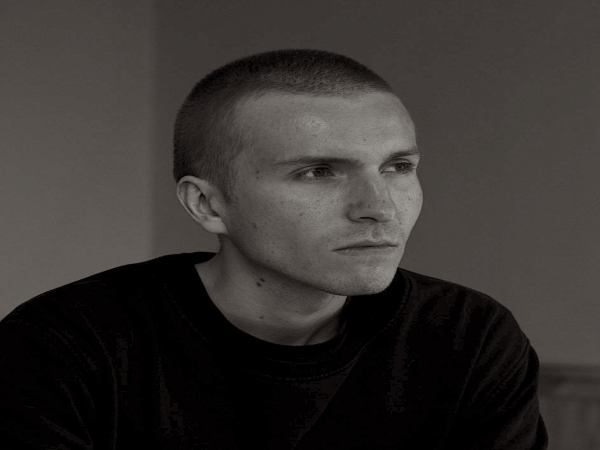

Oliver Rodzianko is a highly respected investment analyst and the founder of Invictus Origin, known for his deep expertise in the technology sector. With a sharp focus on value-driven growth, Rodzianko leverages data-backed strategies and proprietary analytical tools to identify opportunities in artificial intelligence, semiconductors, software, and renewable energy. His insights, widely recognized on platforms such as Seeking Alpha, TipRanks, and GuruFocus, guide investors toward resilient long-term growth while balancing risk and competitive advantage. Rodzianko’s approach blends rigorous fundamental analysis with forward-thinking market perspectives, making him a trusted voice in modern investment circles.

Introduction: A Modern Investment Visionary

In today’s rapidly evolving financial landscape, few voices stand out as distinctly as Oliver Rodzianko. Emerging as a thought leader in investment analysis, Rodzianko has carved a niche through his focus on technology and value-driven growth. Investors and market enthusiasts increasingly turn to his insights for guidance in sectors undergoing transformative change. His work bridges the gap between data-driven decision-making and strategic market foresight, enabling both individual and institutional investors to navigate the complexities of modern markets.

Early Life and Professional Background

While Oliver Rodzianko’s personal life remains private, his professional journey reflects a combination of analytical rigor and entrepreneurial vision. From early exposure to financial markets to mastering advanced portfolio management techniques, Rodzianko built the foundation that would later support the creation of Invictus Origin. His early career included positions in investment research and financial analysis, where he honed the skills necessary to evaluate emerging technologies and assess long-term growth potential.

The Founding of Invictus Origin

In 2025, Oliver Rodzianko founded Invictus Origin, a boutique investment management firm with a mission to deliver high-performance portfolios. The firm emphasizes active portfolio management, disciplined cash allocation, and strategic positioning to navigate both bull and bear markets. Under Rodzianko’s leadership, Invictus Origin has focused on technology-driven industries, particularly those with strong growth potential and sustainable competitive advantages. His work has positioned the firm as a notable voice in the financial sector, despite being relatively new in the market.

Investment Philosophy: Value Meets Innovation

At the heart of Oliver Rodzianko’s strategy is a philosophy that combines value investing principles with innovative market insights. Unlike traditional investors who rely solely on historical data, Rodzianko integrates real-time market trends, macroeconomic indicators, and sector-specific forecasts to guide his decisions. Key elements of his investment philosophy include:

-

Long-term growth focus: Identifying companies that demonstrate sustainable revenue and profit potential.

-

Sector expertise: Special attention to technology, artificial intelligence, semiconductors, software, and renewable energy.

-

Risk management: Strategic cash allocation and portfolio diversification to minimize volatility.

-

Data-driven insights: Leveraging proprietary analytical tools and models to evaluate potential returns.

Sector Focus: Technology and Beyond

Artificial Intelligence (AI)

Oliver Rodzianko recognizes AI as a transformative force across multiple industries. He identifies companies that are not just developing AI but are positioned to monetize it effectively, generating consistent returns for investors.

Semiconductors

The semiconductor industry, critical to both AI and broader tech innovation, is another focal point. Rodzianko assesses supply chain dynamics, technological breakthroughs, and market demand to select high-potential semiconductor firms.

Software

Software companies, particularly those providing scalable enterprise solutions, receive significant attention. Rodzianko evaluates product adoption, revenue streams, and long-term customer retention to identify value-rich opportunities.

Renewable Energy

Beyond technology, Rodzianko’s analysis extends to sustainable energy, an increasingly important sector. He examines regulatory trends, technological advancements, and market growth potential to recommend investments that align with long-term environmental and economic sustainability.

Public Influence and Media Presence

Rodzianko’s insights have gained wide recognition across platforms that cater to investors seeking actionable guidance:

-

Seeking Alpha: Provides in-depth market analyses, stock research, and sector evaluations.

-

TipRanks: Offers transparent performance tracking, stock recommendations, and market sentiment analysis.

-

GuruFocus: Features fundamental analysis and portfolio management strategies.

Through these channels, Rodzianko has built a reputation as a trusted and reliable source of investment knowledge, particularly in the fast-evolving tech sector.

Key Strategies for Investors

Investors following Oliver Rodzianko benefit from several core strategies that reflect his analytical approach:

-

Fundamental Analysis First: Prioritizing companies with strong financials and sustainable competitive advantages.

-

Forward-Looking Metrics: Incorporating technological trends and industry forecasts into portfolio decisions.

-

Balanced Risk Approach: Diversifying investments across sectors and market capitalizations.

-

Long-Term Orientation: Focusing on growth that compounds over time rather than short-term speculation.

-

Data-Driven Decision Making: Using proprietary tools and analytics to optimize entry and exit points.

These strategies reflect Rodzianko’s commitment to resilient investment growth and position him as a leader in modern equity analysis.

Notable Market Insights

Rodzianko has published analyses on companies that are at the forefront of technological innovation. His perspectives often highlight:

-

The strategic importance of AI adoption in enterprise solutions

-

Growth potential in semiconductor companies that drive AI and cloud computing

-

Software businesses with strong recurring revenue models

-

Renewable energy firms positioned for regulatory and technological advantages

By combining these insights, investors can construct well-informed portfolios capable of weathering market volatility while benefiting from technological disruption.

Awards, Recognition, and Industry Impact

Although not a mainstream celebrity, Oliver Rodzianko has earned recognition among investment communities and financial bloggers. His thoughtful, research-driven approach has influenced both novice and professional investors seeking clarity in complex market environments. His contribution lies not only in identifying high-potential investments but also in educating the market about emerging trends and risk-aware strategies.

The Future of Oliver Rodzianko and Invictus Origin

Looking ahead, Oliver Rodzianko aims to expand Invictus Origin’s reach and influence, incorporating advanced analytics and AI-driven decision-making tools to enhance portfolio performance. His commitment to value-driven growth and technology-focused investments positions him as a forward-thinking leader capable of guiding investors through the next wave of market evolution.

Conclusion: A Trusted Voice in Investment Analysis

Oliver Rodzianko exemplifies the modern investment analyst — combining rigorous analysis, technological foresight, and strategic risk management. His focus on high-growth sectors such as AI, semiconductors, software, and renewable energy allows investors to identify opportunities for long-term success. As a founder, analyst, and blogger, Rodzianko continues to influence investment decisions and market perspectives, establishing himself as a trusted, reliable, and forward-looking figure in the world of finance.